Journal of Management and Business Administration, Vol. 1, No. 1, 2016

Author: Innocent Magori Ong’ang’a

Department of Business and Social Sciences, Jomo Kenyatta University of Agriculture and Technology

Email: finiombati@gmail.com

Abstract

Optimal employee performance is at the heart of every organization. However, there are myriad challenges which hinder employee productivity, key among them, employee motivation. Despite all the efforts that organizations continue to put in place to enhance performance, employees’ motivation still remains a big challenge. The main purpose of this study was to examine the motivational strategies affecting employee productivity in banking industry in Kenya. A case study research design was adopted for its appropriateness in terms of providing key background information that can inform further research. The study examined the effect of monetary reward strategy, job enrichment strategy, training and development strategy and team building strategy on employee productivity in the selected commercial bank in Kenya. The sample size consisted of sixty six (n=66) members of staff from 8 branches of the bank. Purposive sampling procedure was used to pick only one commercial bank based on its size by asset. On the other hand, random sampling procedure was used to select the respondents from various branches of the bank. Questionnaire method, owing to its strengths in saving time and upholding the principle of confidentiality, was used to collect data from the respondents. The collected data, being quantitative were processed with the help of Statistical Package for Social Sciences (SPSS). Descriptive statistics were used in data analysis. The analysis revealed that monetary rewards, job enrichment and employee productivity in the selected bank were strongly positively correlated, r(66) = .74, and .67 respectively. However, training and employee productivity were moderately positively correlated, r(66)=.55. The study recommends the modeling of employee motivational strategies for enhancement of employee productivity in the banking industry.

Keywords: Banks’ performance, employee productivity, employee performance, job enrichment, employee promotion, monetary rewards, motivational strategies, training and development, work environment

1. Introduction

Motivation is one of the key strategies that can be used by organizations to achieve better business outcomes (Armstrong, 2006). There are various techniques that can be adopted to motivate people including but not limited to rewards, actions to satisfy needs and psychological processes. This study examines the concept of motivation with reference to banking industry in Kenya.

Today, in an environment of global competition, for banks to achieve long term performance solutions, they must be able to merge motivation and strategy. According to Armstrong (2006), merging motivation and strategy remains one of the best initiatives that should be carried out by management to have a happy and satisfied workforce.

In Kenya, there are forty two commercial banks and one mortgage financial institution (Central Bank, 2016). As the number of banks continues to increase, so are the challenges. Some of the main challenges facing the industry are associated with internal human resource management factors while others are external. The challenges in general include human resource management issues, technological and security risks (Muthini, 2013), regulatory environment and economic melt down (PWC, 2009), among others. Amidst these issues, motivation of the workforce in the banking industry remains the most fundamental component for optimal performance of the industry (Mukhalasie, 2010). However, the extent to which human resource issues have been managed for improved productivity appears to be unclear. Therefore, this study intended to examine the effect of motivational strategies on employee productivity with reference to one selected commercial bank in Kenya.

2. Methodology

The study adopted a case study research design which was quantitative in its approach. This design is the best suited for gathering descriptive information; where the researcher wants to know about people’s feelings, attitudes or preferences concerning one or more variables through direct query (Kothari, 2010). The target population for the study consisted of all the employees of one commercial bank in Kenya located within Nairobi County. The sample size consisted of eighty five (n=85) members of staff from 8 branches of the bank in Nairobi. Out of these, sixty six responded to the questionnaire.

Non-probability and probability sampling procedures were used to arrive at the sample. Purposive sampling procedure was used to arrive at the selected bank given its size by asset and human resources. Random sampling procedure was used to arrive at the sample of the staff members working in the bank.

Questionnaire method, owing to its strengths in saving time and upholding the principle of confidentiality, was used to collect data from the staff members working in the bank. The questionnaire consisted of a series of questions and other prompts for the purpose of gathering information from respondents on the key motivational strategies affecting employee productivity in the case bank.

To establish the validity of the research instrument the researcher sought opinions of experts from the university. This facilitated the necessary revision and modification of the research instrument thereby enhancing validity. Further, the study assessed the responses and non-responses per question to determine if there was any technical dexterity with the questions asked.

After data collection, the filled-in and returned questionnaires were edited for completeness, coded and entries made with the help of the Statistical Package for Social Sciences (SPSS). Descriptive statistics were used in data analysis. The results were reported using frequencies and percentage and summarized in tables and figures.

3.0 Results

3.1 Demographic Characteristics

Slightly over half (55%) of the respondents were males while the remaining 45% were females. The majority (75.8%) of the respondents had attained the university level of education, another 15.2% of them were pursuing or had pursued the second post graduate degree. Only 9.1% had tertiary, certificate, diploma and other certificate programs. A third (33.3%) of the respondents had an experience of 5 years and below. Another 34.8% had an experience of 6-10 years. The remaining 31.8 %, had an experience spanning 11 years and above.

3.2 Monetary Reward factors influencing employee productivity

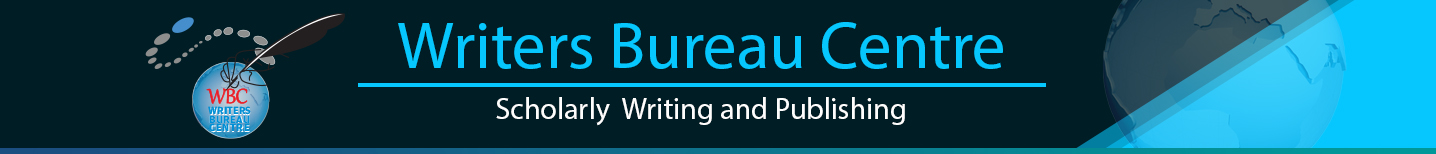

The study examined various monetary reward factors that could be used to motivate employees for better performance. The respondents were asked to indicate the factors in their organization which motivated them the most and helped increase their performance. The hypothesized factors included salary, allowances, annual bonuses and annual increments. Figure 1 shows the distribution of the respondents by the reward factors that motivated the employees the most.

Half (50%) of the respondents indicated that salary motivated the employees the most and helped increase productivity. Other factors such as allowances (10.6%), annual bonuses (15.2%) and annual increments (19.7%) also contributed to some extent to the motivation of the employees in the bank.

3.3 Job Enrichment Strategies Influencing Employee Productivity

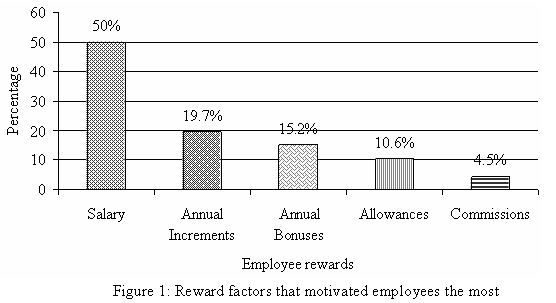

The study sought to find out the enrichment strategies that influenced employee productive in the case bank. The strategies considered included work environment, work load and promotion. Figure 2 shows the distribution of the respondents.

The majority (73%) of the respondents indicated that job promotion motivated them the most. Another 15% of them indicated that work environment motivated them the most followed by 12% who felt that recognition was the major motivational strategy.

3.4 Effect of Training on employee performance

In order to establish whether training influenced performance, the respondents were asked to indicate if they could perform well without being trained. A vast majority (77%) felt that they could not perform well without training and development. However, the remaining 23% indicated they performed well without necessarily having undertaken further training and development.

3.5 Correlation between motivation strategies and employee productivity

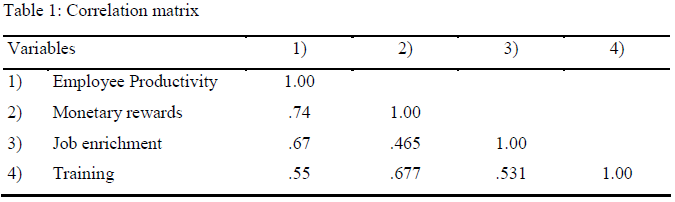

Correlation analysis was performed in order to determine the association between the various motivational strategies and employee productivity in the selected bank. Table 2 shows the correlation matrix.

Monetary rewards and Employee Productivity were strongly positively correlated, r(66) = .74. . Job enrichment and employee productivity were also strongly positively correlated, r(66) = .67. However, training and employee productivity were moderately positively correlated, r(66)=.55.

4. Discussion

A number of studies have been conducted in the past on factors influencing employee performance. Employee motivation is one such major factor of performance. Motivation has been linked with factors such as monetary rewards, employee training and development, and job enrichment factors such as promotion which are known to influence employee productivity (Muogbo, 2013; Armstrong, 2006). This study found that monetary rewards and employee productivity were strongly positively correlated, r(66) = .74. This is consistent with what Armstrong (2006) observes that when employees are motivated through monetary rewards, their performance of work is high. According to this study, pay was the most influential motivational strategy of monetary nature. Others included annual bonuses and annual increments. Commissions also played some role towards motivating employees for enhanced performance.

The study also examined three job enrichment strategies that are likely to influence employee motivation and therefore their productivity. These factors included promotion, work environment and recognition. Interestingly, among these factors, promotion was the most favourable factor of employee motivation, with 73% of the respondents indicating that it motivated them the most. An earlier study by Malik, Danish & Munir (2012), also showed that promotion had some influence and partially significant to the job satisfaction. Interestingly, only 15% of the respondents indicated that they were motivated most by work environment. Previous studies have shown that work environment motivates employees and helps to improve performance. A study by Ajala (2012) showed that workplace environment had an effect on “worker’s welfare, health, morale, efficiency, and productivity”.

Owing to the need for better performance, organizations continue to create opportunities for employee training and development. Whether the money and energy spent in employee training is paying off in the baking sector is another question altogether. This study found that employee training and productivity in the selected bank were moderately positively correlated, r(66)=.55. Along this line, Wright & Geroy (2001), observe that employee competencies which are gained through training not only improve employee overall performance but also builds knowledge, skills and attitudes that further contribute to personal and organizational development. Despite the role played by employee training, it is not by default that it influences performance without further integration of other employee motivational strategies.

Given this discussion, it is only fair to deduce that various motivational strategies contribute to employee performance. This is to say, that employee performance is not limited to adoption of one motivational strategy but to an integration of the major factors including but not limited to monetary rewards, promotion, work environment, recognition and training. There are also personal drive factors that play a critical role in employee motivation and therefore the very performance.

5. Conclusions

The study concluded that:

Monetary rewards such as pay, allowances, annual bonuses and annual increments are highly likely to improve the bank’s employee motivation and therefore their productivity.

Promotion is a major strategy of motivation which can be used by the bank to build employee motivation and therefore their productivity.

Employee training and development is another major factor of employee motivation which the bank can embark on. However, its influence is not directly proportional to employee productivity since there are other confounding factors.

References

Ajala, E.M. (2012). The influence of workplace environment on workers’ welfare, performance and productivity. The African Symposium, Volume 12 (1).

Armstrong, M. (2006). A Handbook of Human Resource Management Practice, 11thEdition, Kogan Page.

Central Bank of Kenya [CBK] (2016). Commercial Banks & Mortgage Finance Institutions. Retrieved from https://www.centralbank.go.ke/index.php/bank-supervision/commercial-banks-mortgage-finance-institutions.

Price, Waterhouse and Coopers [PWC] (2009). Key issues facing the banking industry in Kenya. Retrieved from http://www.pwc.com/ke/en/industries/banking-issues.html

Malik, M.E., Danish, R.Q. Munir, Y. (2012). The Impact of Pay and Promotion on Job Satisfaction: Evidence from Higher Education Institutes of Pakistan. American Journal of Economics, Special Issue: 6-9. DOI: 0.5923/j.economics.20120001.02.

Mukhalasie, M. (2010). An analysis of the factors affecting strategy implementation in Kenya commercial bank. Unpublished thesis, USIU.

Muthini, B. (2013). Challenges facing commercial banks in Kenya due to e-banking. Retrieved from http://www.academia.edu/4505014/

Muogbo, U.S. (2013). The Influence of Motivation on Employees’ Performance: A Study of Some Selected Firms in Anambra State. An International Journal of Arts and Humanities, Vol. 2 (3).

Wright, P. & Geroy, D. G. (2001). Changing the mindset: the training myth and the need for word-class performance. International Journal of Human Resource Management 12(4).

DOWNLOAD Full Text in PDF ![]()