Journal of Management and Business Administration, 2(1), 2019

Authors: 1 Stephen Ng’ang’a Njoroge and Peter Gichuki Wambugu 2

1,2Presbyterian University of East Africa,

School of Philosophy and Religious Studies,

P.O Box 15591-00503, Mbagathi, Nairobi – Kenya

Corresponding Author E-mail: Stephen.njoroge@puea.ac.ke

ABSTRACT

Small and Medium Enterprises in Kenya are faced with the threat of failure with past statistics indicating that three out of five fail after the first few months of their startup. The growth of Small and Medium sized Enterprises (SME) is influenced by several factors. Although there has been research into these factors and how they contribute to the growth of SMEs, there appears to be few studies covering the influence of capital on growth of SMEs in Nairobi. This study therefore aimed at establishing the influence of capital on growth of Small and Medium Enterprises in Githurai Forty Five Kiambu County, Kenya. The study adopted a survey research design. The target population in this study comprised five hundred Small and Medium Enterprise business men in Githurai Forty Five. Random sampling procedure was adopted in selecting a sample size of two hundred and seventeen respondents using Krejice and Morgan sample size determinant table. The research instrument used in the study was a questionnaire. Data analysis was conducted using Statistical Package for Social Sciences (SPSS) version 21.0 and findings presented using frequencies and percentages. The Study concluded that, lack of startup capital hinders the growth of Small and Medium Enterprises in Githurai Forty Five, Kiambu County. The study recommends that the County government of Kiambu should build supportive policies on financing businesses such as developing County funds for Small and Medium Enterprises as well as subsidizing county levies.

Keywords: Capital and growth, small business enterprises, capital and SMEs, financing and SMEs, growth of SMEs, Githurai SMEs Growth

INTRODUCTION

Small and Medium Enterprises contribute greatly to the growth of economies. Historically, these enterprises have played a key role in job creation, implementation of technologies, and generation of new products thus contributing to vitality in the economy (Nubler, 2016). In the developed world, countries such as Germany stand out since they are dominated by SMEs (OECD, 2017). In addition, the workforce in SMEs in Germany are a third of the its entire labor force (OECD, 2017). In a study by Randall and Lee (2018) in newly industrialized Asian countries, SMEs have been noted to be the engines of growth in these economies. In South Korea for instance, SMEs account for 99% of all enterprises in the country (Randall and Lee, 2018). Moreover, 88% of all the country’s labor force has been employed in these enterprises (Randall and Lee, 2018). According to Gibbs (2007), these trends across the globe dictates that African nations need to enhance the growth of SMEs in their economic systems.

The International Labour Organization (2015) regards SMEs as those entities with 11 – 50 employees. Locally, SMEs are identified by their number of employees and annual sales turnover (Nyoike, 2019). Specifically the number of employees should not be more than 100 and the annual turnover should not be more than KES 150 million (Nyoike, 2019). Therefore, in line with the vision 2030, the promotion of Small and Medium Enterprises is among the initiatives to make Kenya a prosperous and globally competitive nation (GoK, 2007). However, sustainability and growth of SMEs faces numerous challenges. Factors such as liberalization, competition from new entrants, the need for improved standards as well as innovation have necessitated these enterprises to raise their efficiency levels and adopt a proactive approach in response to changes in the market.

A major challenge hindering growth of SMEs is the accessibility to capital. Sole proprietors who venture into these enterprises lack sufficient funds to start and boost their business. Starcher (2008) notes that SMEs need some capital assistance for start-ups regardless of whether the funds can be obtained through loan financing or accrued savings. The study by Starcher (2008) further established that many entrepreneurs in the developing world have minimal opportunities to access funds. According to Starcher (2008) this observation is attributed to the fact that these entrepreneurs live in either rural or urban communities and in these communities, opportunities to access capital funds are limited.

A study by Scohol (2010), asserts that a lot of youth view capital shortage as the biggest hindrance to setting up their businesses. The research by Scohol (2010) further notes that capital shortage seems to be more of a barrier to entrepreneurship that administrative bureaucracies or disparaging economic environment. Elsewhere, Macharia and Wanjiru (1998) in a study on Non-Governmental Organizations (NGOs) and SMEs, established that the accessibility to funds were a major hindrance to entrepreneurial growth. Results from this research revealed the following to hinder access to capital: high interest rates; poor awareness of credit schemes; lack of collateral for credit financing and loan applications that are dominated by high level bureaucracy. The aforementioned factors have become a hindrance to the growth of community owned SMEs. Further, potential for growth of the SME sector in Kenya is known to have poor implementation of technology. Technology and all aspects surrounding it relate to capital financing which affects the SME sector since it contributes to low quality and productivity, inadequate product range and low competitiveness. Many studies have been conducted in relation to factors affecting Small and Medium Enterprises. However, it appears there is a knowledge gap in the studies related to the influence of capital on the growth of Small and Medium Enterprises in Kenya (Dondo, Kigira, Bokea, Nyamweya and Kabiru, 1997). Therefore, this study intended to examine the influence of capital on growth of Small and Medium Enterprises in Githurai Forty Five in Kiambu County, Kenya.

METHODOLOGY

The study adopted a descriptive survey research design. Given that Githurai Forty five comprised Small and Medium Enterprises of all kinds, its findings were generalized to reflect the on how capital influences growth and development of Small and Medium Enterprises in Githurai Forty Five Kiambu County, Kenya.

The target population comprised of 500 Small and Medium Enterprises in Githurai Forty five. The study utilized stratified sampling method. The stratified sampling method measures the overall population parameters with greater precision and ensures an extraction of a representative sample from a relatively homogenous population. On the other hand, the proportionate stratification ensures that the sample size of each stratum, which is represented in various departments, is proportionate to the population size of the stratum (Kothari, 2004).

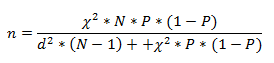

The sample size was determined using Krejcie and Morgan’s method of determination of a sample size for a given population size. As indicated by Krejcie and Morgan (1970), if the target population is finite, the following formula may be used to determine the sample size:

Where:

n = required sample size.

= the table value of chi-square for 1 degree of freedom at the desired confidence level (3.841).

N = the population size.

P = the population proportion (assumed to be .50 since this would provide the maximum Sample size).

d = the degree of accuracy (the margin of error) expressed as a proportion (.05).

From the target population of 500 respondents, a sample size of 217 respondents was generated by use of Krejcie and Morgan’s method of determination of a sample size.

In this study, the research instrument utilized for data collection was a questionnaire. The questionnaire was semi-structured and comprised both closed ended and open ended questions.

Quantitative data collected was run through the statistical package for Social Science (SPSS) version 21.0 in order to obtain effective results. Findings from the study were presented using frequencies and percentages. Linear regression analysis was used as inferential statistics to establish the association between capital and growth of Small and Medium Enterprises. Tables were used to summarize the results.

RESULTS

Socio-demographic Characteristics

The study sought to establish the demographic data of the respondents with the aim of establishing the distribution based on gender, how long the respondent had operated the business, level of education and type of business. Results obtained showed that 54.4% of the respondents were male whereas 45.6% were female. In terms of age, 41.71% of the respondents were between 18 and 35, 32.62% were between 36 to 53 years, 14.44% were between 54 to 60 years and only 11.23% were above 61 years of age. Further, findings from the study indicated that 41% of the respondents had operated their business for a period of 4 to 6 years, 30.4% for 2 to 4 years, 21.7% for more than 6 years, while 6.9% of the respondents indicated less than one year. With regards to education, 47.9% of the respondents had attained College diploma certificates, 44.7% had attained Kenya Certificate of Secondary Education, 7.4% of the respondents had attained university education while 11.55% had attained primary education. Results on business ownership show that 77.4% of the respondents were in a sole proprietorship while 22.6% were in partnership business.

Influence of Capital on Growth of Small Scale Business

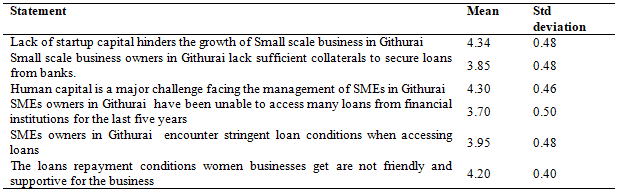

The study further sought to examine influence of capital on growth of Small and Medium Enterprises in Githurai Forty Five, Kiambu County. Participants were asked to indicate the extent to which they agreed with the following statements assessing the influence of capital on growth of Small and Medium Enterprises in Githurai Forty Five, Kiambu County: Lack of startup capital hinders the growth of Small scale business in Githurai, Small scale business owners in Githurai lack sufficient collaterals to secure loans from banks, Human capital is a major challenge facing the management of SMEs in Githurai, SMEs owners in Githurai have been unable to access many loans from financial institutions for the last five years and SMEs owners in Githurai encounter stringent loan conditions when accessing loans. Table 1 shows the distribution based on the influence of capital on growth of Small and Medium Enterprises in Githurai Forty Five, Kiambu County according to responses.

Table 1

Influence of Capital on Growth of Small Scale Business

Table 1 shows that majority of the respondents agreed that lack of startup capital hinders the growth of small scale business in Githurai (mean = 4.34, std dev =0.48), human capital is a major challenge facing the management of SMEs in Githurai (mean = 4.30, std dev =0.48) and that the loans repayment conditions SMEs owners get are unfriendly and not supportive for the business (mean = 4.20). The study further revealed that SME owners in Githurai encounter stringent loan conditions when accessing loans (mean = 3.95 std dev = 0.48), small scale business owners in Githurai lack sufficient collateral to secure loans from banks (mean = 3.85 std dev = 0.48) and SMEs owners in Githurai have been unable to access many loans from financial institutions for the last five years (mean = 3.70 std dev = 0.50).

Association between Capital and Growth of SMEs

The study examined the association between capital and growth of SMEs. Linear analysis was conducted in order to establish the association between capital and growth of SMEs in Githurai Forty Five. Tables 2, 3 and 4 show a summary of linear regression analysis results based on model equation: Y = a + bX

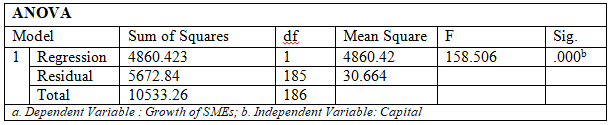

Analysis of variance was performed in order to establish whether there is any significant association between the capital and the growth of SMEs in Githurai Forty Five.

Table 2

ANOVA results

As shown in Table 2, probability value of .000 indicates that the regression relationship was statistically significant in predicting how capital influenced the growth of Small and Medium Enterprises in Githurai Forty Five.

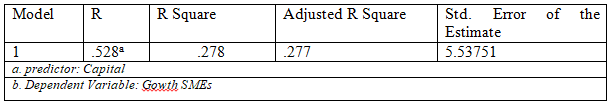

In order to determine how well capital explained the dependent variable (SMEs growth), R computation was carried out. Table 3 shows the R squared results.

Table 3

Model Summary

As shown in Table 3, the adjusted R square for the regression analysis of capital and growth of Small and Medium Enterprises in Githurai Forty Five was .278. This shows relatively moderate fit of the predictor (capital) into the model.

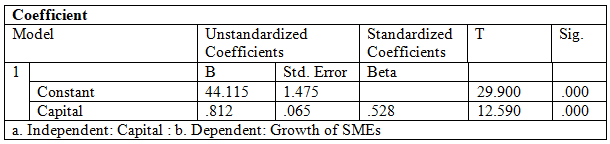

In order to determine the importance of the independent variable (capital) in predicting dependent variable (growth of SMEs), the model’s parameter estimates (coefficients) were computed. The results are shown in Table 4.

Table 4

Coefficients

Based on the results in Table 4, the coefficient associated with the regression constant is 44.115 with a standard error of 1.475. The coefficient associated with the predictor, namely capital is .812 with a standard error of .065. From the results, the coefficient associated with capital was statistically significant since its associated p-value (.000) is less than the level of significance, P<.05

Consequently, the linear regression model can be stated as: Y = 44.115 +.812 X1

DISCUSSION

Results obtained show that majority of the respondents agreed that lack of startup capital hinders the growth of small scale business in Githurai, human capital is a major challenge facing the management of SMEs in Githurai and that the loans repayment conditions SMEs owners get are unfriendly and not supportive for the business. These findings are in line with a study by Dawuda, (2015) which established that lack of low cost capital was a major bottleneck in development of micro, small and medium enterprises

The study further revealed that SMEs owners in Githurai encounter stringent loan conditions when accessing loans, small scale business owners in Githurai lack sufficient collaterals to secure loans from banks and SMEs owners in Githurai have been unable to access many loans from financial institutions for the last five years. The findings concurs with the study findings by Chase et al. (2006, p.53) lack of available credit and a difficulty in accessing business loans for working capital is negatively affecting growth of SMEs.

The research found a significant positive association between capital and growth of SMEs in Githurai Forty Five, Kiambu County. This concurs with a study by Schoof (2006) which found out that raising capital had been identified as a major problem for entrepreneurs. Specifically, the study established that for many young entrepreneurs, financing their businesses appeared to be the major problem faced with inadequate start-up finance being one of the most prominent impediments to their small scale businesses. Quite a number of people in Githurai Forty Five had risen from small scale businesses to big businesses. This means that SMEs can prosper if facilitated with finances to start and run Small and Medium Enterprises.

CONCLUSION

The availability and accessibility to capital funding is one of the major barriers to growth of Small and Medium Enterprises in Githurai Forty Five, Kiambu County. Specifically, this research revealed that lack of startup capital hindered the growth of small and medium enterprise in Githurai and that human capital was a major challenge facing the management of SMEs in Githurai. Further the study showed that the loans repayment conditions SMEs owners get are unfriendly and not supportive for the business. Generally, people who venture into small businesses in Githurai Forty Five do not have sufficient capital or funds to boost their business.

The study further concluded that there is a significant positive association between capital and growth of Small and Medium Enterprises in Githurai Forty Five, Kiambu County. Increased levels of capital accessibility therefore would lead to an increase in growth of SMEs in Githurai Forty Five.

The study recommends that the County government of Kiambu should implement policies on financing businesses. Such policies may include developing a County fund for Small and Medium Enterprises as well as subsidizing county levies. Further, business people should also join savings and credit institutions to be able to access capital. The study also recommends that women, youth and physically challenged people form groups that will enable them access government funds such as UWEZO fund and Youth fund. Additionally, needy people should develop a good will with suppliers in an arrangement where they can be supplied with goods and pay after sales.

REFERENCES

Dondo, A., Kigira, B., Bokea, C., Nyamweya, P. and Kabiru, C. (1997). Improving Access to Infrastructure for Micro Enterprises Development in Kiambu. ICEG Research paper, Nairobi Kenya

Gibbs, A. (1997). Focus groups. Social Research Update, Issue Nineteen.

GoK. (2007). Community-based Tourism Enterprises Development in Kenya: An Exploration of Their Potential as Avenues of Poverty Reduction. Journal of sustainable tourism, 15(6), pp.628-644

Kothari, C.R. (2004) Research Methodology: Methods and Techniques (2nd Edition), New Delhi: New Age International Publishers.

Krejcie, R.V. & Morgan, D.W. (1970). Determining Sample Size for Research Activities. Educational and Psychological Measurement. 30: 607-610.

Larry, J. & Damien, C. (2010). The Future of Business. Texas: South Western College Publishing.

Madura, F.C. ( 2014). Introduction to 3 E Businesses. Canada: Florida Atlantic university

Ronald, J. A. & Ricky, W. G. (2011). Business Essentials (8th edition). Edinburg: Pearson education Limited.

Schoof, U. (2006). Stimulating Youth Entrepreneurship: Barriers and Incentives to Enterprise Start-ups by Young People. International Labor Organization

Scohool, J. (2010). Prediction and Control Under Uncertainty: Outcomes in Angel Investing. Journal of Business Venturing, 24(2), pp.116-133.

Starcher, H. H. (2008). A Paradigm of Entrepreneurship: Entrepreneurial Management. Entrepreneurship: Concepts, theory and perspective, pp.155-170.

Macharia, W. L., and Wanjiru, M.L., 2012. Formal Credit Financing for Small Scale Enterprises in Kenya: A case Study of NGOs and Small Scale Women Entrepreneurs in the Garment Manufacturing Sector of the Textile Industry in Nairobi and Nyeri from 1955 to 1996 (Doctoral dissertation).

William, M., Robert, J. & Jack, R. (2008). Business (9th edition). Boston: Haveghton Miffilin Company.

Suggested Citation:

Gichuki, W. & Njoroge, S. ( 2019). Influence of Capital on Growth of Small and Medium Enterprises in Githurai Forty Five in Kiambu County, Kenya. Journal of Management and Business Administration, 2 (1). pp. 24 – 31.